Don’t get caught watching the paint dry on new LNG export facilities

By Jeff Bolyard

LNG exports have been the largest growing demand for natural gas in the U.S. for several years now. In December 2024, Plaquemines LNG on the coast of Louisiana shipped its first cargo, and over the past month, it has averaged 1.98 billion cubic feet per day (Bcf/day) of natural gas demand. Year-over-year, March has shown a remarkable 2.68 Bcf/day increase in LNG demand.

Though the paint is barely dry on Plaquemines Phase 1, Plaquemines Phase 2 is under construction and anticipated to be in production in the next 12 months. It will add another 1.58 Bcf/day of capacity. Corpus Christie Stage 3, which has seven midsize LNG trains and is well ahead of the announced construction schedule, will add another 1.3 Bcf/day. ExxonMobil’s Golden Pass project, which has three trains, each with a nominal capacity of 0.68 Bcf/day and 2 Bcf/day in aggregate, will also be taking test gas in the next 8-18 months.

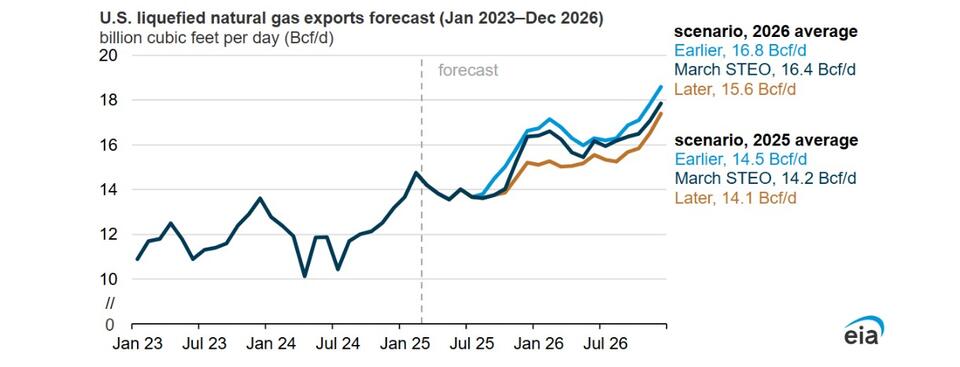

The biggest challenge to the near-term gas market is when this capacity will be added. In the chart below from its March 2025 Short-term Energy Outlook, the U.S. Energy Information Administration (EIA) put together a forecast of LNG exports through the end of 2026 based on three different scenarios, each centered around the completion times of the new LNG export projects. Depending on when the facilities are set to come online, the amount of incremental demand could vary by as much as 0.4 Bcf/day in 2025 and 1.2 Bcf/day in 2026, which is significant based on what can be seen fundamentally in the market today.

Adding to this unknown variable is the fact that summer is yet to come, and weather severity is unknown. Underground storage is still over 20% behind last year’s levels at 1.84 trillion cubic feet (Tcf), while natural gas production has drifted off its March highs so far in April.

In one of my favorite movies, “Hoosiers,” a high school basketball team from Indiana overcomes many challenges to win the state championship in 1954. During an intense scene where the tired, undersized, and overmatched team is behind by a point with just a few seconds to go and needs guidance during their final timeout, assistant coach “Shooter” Flatch, played by Dennis Hopper, provides the game-winning play to the young men and sends them back onto the floor with these final words: “Now boys, don’t get caught watchin’ the paint dry!” In saying this, Shooter wants to make the players keenly aware of their current situation, utilize their training and experience, and realize their ability to control how they react to the situation while being aware of circumstances beyond their control.

Since March 10, natural gas NYEMX futures prices for the remaining summer strip (May-Oct) have fallen $1.36 and are now at $3.42/MMBtu, while the upcoming 25/26 winter strip is off $0.91 and trading at $4.28/MMBtu. If you aren’t comfortable waiting to see how the wave of new LNG exports and other fundamentals will affect natural gas pricing over the next eight months, take advantage of what the market has provided already and don’t get caught watching the paint dry.