How the trade war with China on ethane could end up boosting U.S. natural gas production

By Jeff Bolyard

Ethane is a liquid hydrocarbon and a significant component of natural gas production. The primary market of ethane is the petrochemical business, which uses it as a feedstock to make plastics, resins and synthetic rubber. However, if there isn’t enough demand in the Petrochem market, or the price for ethane isn’t worth the cost to process it out of the natural gas stream, ethane can be “rejected” and left in the natural gas stream. However, there are limits to how much can be left due to its liquid nature and higher btu content than methane. With the growth of natural gas production in the U.S. over the past decade, the volume of ethane exceeded the domestic petchem demand and an export market was needed. Here’s where China comes in.

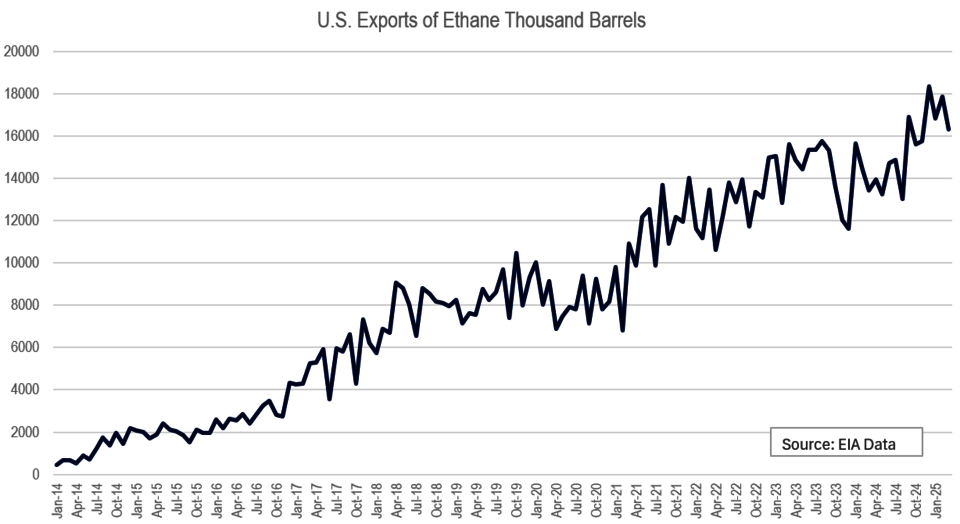

Starting in 2014, the U.S. began exporting and ended the year sending 13.8 million barrels of ethane to international markets. Over the last decade, that volume has grown 13-fold and in 2024, the U.S. exported over 180 million barrels, making it the world’s largest ethane exporter, with 47% of that total going to China last year. The chart below shows the growth of exports over that period.

In May, the Department of Commerce’s Bureau of Industry and Security did not renew the necessary export licenses for the continued export of ethane to China, indicating concerns that the commodity could be used for military purposes. While many believe this to be a negotiating lever for the larger trade negotiations between the two largest economies in the world, it could have a longer lasting impact on U.S natural gas production should the effective ban of supply to China remain. As of June 16, data from Vortexta indicated nearly a quarter of the Very Large Ethane Carrier (VLEC) fleet which is used to export ethane along the Gulf Coast, was no longer active and an indication that ethane exports were already declining.

If you recall, absent a sufficient price of ethane that would pay for the processing to remove it, more ethane would be “rejected” and remain in the natural gas stream. The impact of this extra volume would increase the volume of natural gas being marketed.

Estimates of how much natural gas production would increase as a result of rejected ethane vary based on sources, but all agree that natural gas production could increase from a conservative volume of 300,000 MMBtu/day to as much as 2 Bcf per day. Ethane is coming out of the gas stream and has to go somewhere. With the largest ethane market of China being at risk and limited other places for it to go, much of it is likely to be left in the gas stream.

The increase in natural gas production from ethane rejection across the country should help offset the growing LNG export demand and summer power generation demand that is upon us. With speculative long positions growing, watch for opportunities to buy dips should the fundamental picture shift and we catch a break from the current heat wave. Of course, the extra natural gas production from ethane could disappear tomorrow should a long-term trade agreement between the U.S. and China materialize.