Where is Appalachian natural gas headed — and what forces will shape its trajectory?

By Jeff Bolyard, Principal, Energy Supply Advisory

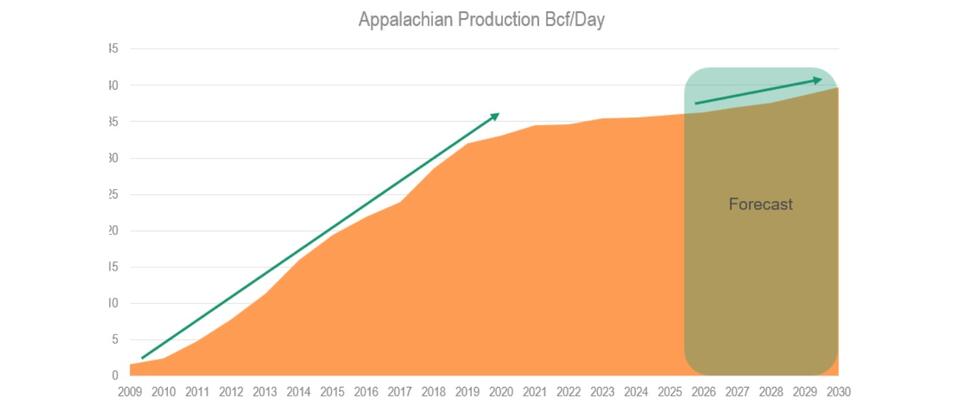

Natural gas sourced from the Marcellus and Utica shale plays in Appalachia experienced exponential growth from 2009-2019, producing an average of 1.7 Bcf/day in 2009 and rising to an average of 32 Bcf/day in 2019, with year-over-year growth averaging an additional 3 Bcf per day more each year.

During that period, the growth was driven by a “supply push” period, when producers invested heavily in pipeline expansions and brand-new greenfield pipelines to reach markets with their inexpensive gas. By the end of Appalachia’s golden growth decade, the initial push towards renewable energy was in full swing, COVID demand destruction hit, and policy, regulation and litigation made building new gas pipelines across state lines all but impossible.

From 2019-2025 YTD, gas production growth from the region was dismal relative to the previous decade, growing an average of just 0.81 Bcf/day each year, and averaging 35.8 Bcf/day so far in 2025.

So, what hope does that leave for the region over the next five years? The outlook hinges on several scenarios, some pointing to a growth spurt in Appalachian gas production. The two most likely drivers for that growth are:

A.) Intra-regional demand from data centers. AI growth is increasingly looking towards natural gas as the go-to fuel to get operations up and running, with both Pennsylvania and Ohio attracting significant numbers of data centers. These two states sit atop significant gas reserves, and with less red tape for building gas infrastructure, offer a much easier pathway to significant production growth.

B.) Existing infrastructure for natural gas. While building brand new interstate pipelines will likely be difficult, expanding existing lines is much easier, and Appalachian pipelines possess significant rights-of-way to enable that. Much of the growth from 2009-2019 came from greenfield interstate pipelines. Those lines now connect to other markets, many of which can be expanded with additional compression or by looping pipe within the same right-of-way.

Numerous expansions are underway to serve the growing power generation demand in Virginia, North Carolina, South Carolina, and Georgia. On November 7, New York and New Jersey authorized water permits for Williams Northeast Supply Enhancement (NESE) project that had been held up for several years. NESE would provide 400,000 MMBtu/day of natural gas to these two states, supplied by Appalachia, supporting further production growth.

The history and forecast for Appalachian gas production are shown in the chart below.

But not all things are working in favor of another bust-out decade of natural gas growth from Appalachia’s primary producing states of Pennsylvania, Ohio, and West Virginia. While the One Big Beautiful Bill Act (OBBBA) introduced measures to expedite approvals for certain infrastructure projects, which would help get both gas pipelines and power transmission built, it also delayed the retirement of many coal-fired generation assets and significantly shortened the timeline for subsidies for renewable generation.

In the short term, the OBBBA provisions will increase switching from gas to coal-fired generation and significantly accelerate renewable additions over the next two years to take advantage of the sunsetting federal tax credits (ITC and PTC). Both will eat into expected natural gas demand, reducing growth in Appalachia. The net effect of these positives and negatives will likely be a modest increase in gas production, rather than a repeat of the prior decade’s surge.