What the One Big Beautiful Bill Act Means for Energy Buyers

The One Big Beautiful Bill Act (OBBBA), passed into law on July 4, introduces major shifts to the U.S. energy landscape, including early phaseout of key clean energy tax credits, new restrictions tied to foreign entities, and measures promoting fossil fuel development. But while the Act serves up some significant challenges, including the tightening of tax credit eligibility for wind and solar projects, it also presents several noteworthy opportunities such as a near-term window to access the full tax credits and the benefit of 100% bonus depreciation on projects. Here’s a breakdown:

OBBBA Impacts on the Energy Sector:

- Wind and solar face headwinds

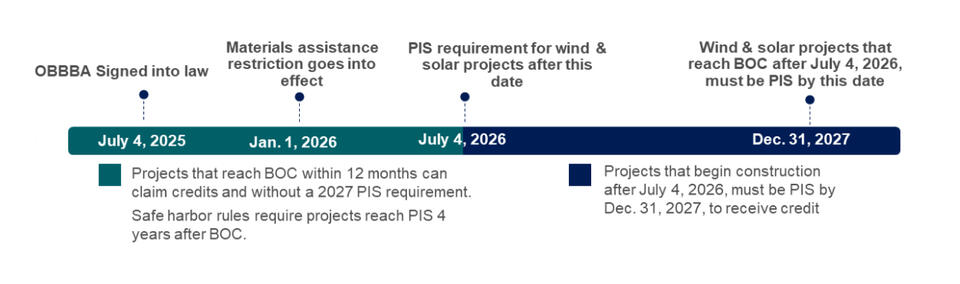

The law accelerates the phaseout of the clean electricity production (45Y) and investment (48E) tax credits for wind and solar. Projects that begin construction prior to July 4, 2026, can claim full credit value without a placed-in-service (PIS) requirement. Projects that begin construction after that date must be PIS prior to December 31, 2027, to qualify before the tax credits fully expire in 2028.

Please see below for the wind and solar phaseout timeline:

- “Clean firm” resources maintain tax credit eligibility

Nuclear, hydropower, geothermal, and energy storage qualify for the full credit value for 45Y and 48E through 2033, with a gradual phasedown through 2036. Maintaining these credits is critical not only for the continued deployment of battery storage but also for bringing emerging technologies like advanced geothermal and small modular reactors to commercial viability. - Compliance costs and project risks escalate

New "foreign entity of concern" (FEOC) restrictions apply to most energy tax credits, prohibiting projects with ties to entities from China, Iran, North Korea, or Russia. The law also introduces material assistance thresholds requiring developers to audit and prove that their supply chains are sufficiently free from FEOC influence. This is expected to add complexity and cost.

Importantly, the material assistance restriction does not take effect until January 1, 2026, providing a critical window for near-term projects to maintain credit eligibility. - Fossil fuel extraction is bolstered

The OBBBA mandates new onshore and offshore oil and gas lease sales, lowers royalty rates, and opens Arctic areas for drilling, further incentivizing fossil fuel development. - Electricity prices are likely to rise

With fewer wind and solar projects coming online post-2027, grid operators may rely on natural gas and coal to meet growing demand. Given underdeveloped advanced nuclear and geothermal markets and expected natural gas turbine shortages through 2030, this could lead to higher electricity prices and increased market volatility.

Executive Order Implications

On July 7, President Trump issued an executive order directing the Department of the Treasury and Department of the Interior to develop new or revise existing guidance for wind and solar projects by August 18 that:

- Tightens the “beginning of construction” safe harbor rules, looking to more stringently apply the criteria to ensure that projects are reaching significant levels of construction to claim credits.

- Implements new FEOC guidance to align with the OBBBA.

- Revises policies that give preferences to wind or solar, potentially slowing permitting or restricting access to federal lands and rights of way.

While the executive order introduces more stringent requirements for wind and solar projects, the quick timeline of the order does provide some benefits. Early development of FEOC rules will allow more time for developers to assess requirements and workshop solutions ahead of their effective date. Additionally, although changes to safe harbor provisions are expected to tighten standards, developers who already follow current best practices are likely well-positioned to navigate the new rules.

Recommendations for buyers

The OBBBA and July 7th executive order create a challenging environment for clean energy developers, particularly in wind and solar. Developers face tighter timelines to secure tax credits, complex new compliance requirements, and increased regulatory oversight.

For buyers looking to navigate this evolving landscape, there is a window to access projects that benefit from the federal tax incentives. The Act has different implications for buyers of onsite projects that have not yet been taken to market and utility-scale projects that have been in development for years.

Onsite buyers have an opportunity to secure projects that receive the tax incentive as well as the benefit of the 100% bonus depreciation changes in the Act. Projects would likely need to meet the end of 2027 PIS date if engineering, procurement and construction (EPC) agreements or PPAs are not currently being negotiated with developers. Buyers should have onsite PPAs executed by Q3 2026 to ensure that the project can be built and placed in service in time to receive the full credit.

Offsite renewable energy projects take years to develop, and many projects will start construction prior to July 4, 2026, in order to be exempt from the PIS deadline. Projects starting construction after December 31, 2025, will be subject to the pending FEOC guidelines. While many project developers will find a way to meet the FEOC guidelines, the timing of the final rules and the potential risk to investors means that those projects are at higher risk of failing to qualify for the ITC/PTC.

The best option for buyers is to contract for a project that has already started construction or does so in 2025 and has a clear path to being operational by the end of 2027. This inventory will be in short supply and high demand. It is critical for interested buyers to move quickly; however, they need to be prepared and have approvals lined up rather than jumping into the market and potentially not moving fast enough or losing a project to another party.

These important steps should be taken to prepare for the successful procurement of offsite or onsite renewable energy:

- Confirm your strategy – identify your sustainability goals, the risks you are willing to take, where you want the project located, the type of project you are looking for, and any specific project characteristics that meet your company’s goals.

- Gain internal alignment on the need for a fast-moving process – initial approvals will be needed based on what you can expect in the market for terms and cost; contract negotiations must be expedited with a clear understanding of the terms and their options that are most critical to your company.

- Work with someone who understands the market landscape – you need to know what process to expect, the terms you will likely get, and the cost range of the contract. Your company also needs to determine if bypassing the RFP is the right step to save time by working with a shortlist of projects that match your company’s procurement goals.

- Perform proper due diligence – the worst scenario for both your company and the project is a protracted procurement process and an undeveloped project. In addition, there may not be another chance to procure a project that can access the tax credits. Proper due diligence on the developer partner - their track record, supply chain strategy, EPC strategy, financing model, and partners - is critical. Project-level due diligence on permitting, interconnection, basis, financing plans, offtake arrangements, contract structure, construction timeline, and component sourcing are even more vital than a typical procurement to ensure that there are no major issues that could stop the project from meeting the December 31, 2027, deadline.