Solar/Coal teaming up to take power generation market share from natural gas

By Jeff Bolyard, Principal, Energy Supply Advisory

Historically, solar power and coal-fired generation have been positioned as being antithetical to one another. And yet, for the last 10 months, these strange bedfellows have teamed up to increase their year-over-year power generation contributions at the expense of natural gas. Granted, natural gas still comprised 45.6% of the total generation for the month of September, but this is 1.6% lower than it was in September 2024.

Coal-fired generation has consistently been on a downward trend since 2009, except on rare occasions when extreme weather required an increase in coal to meet demand. Utility- scale solar has shown consistent year-over-year growth for several years. Natural gas has been the beneficiary of declining coal-fired generation for over a decade, but this year we have seen a shift in how these three separate but linked sources of power generation are reacting to each other in the current energy market.

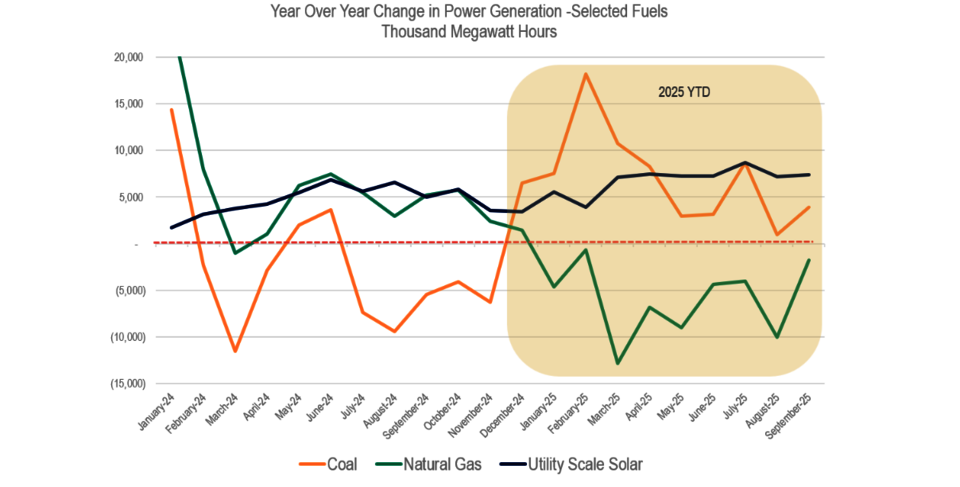

The chart below goes back to January 2024 and shows year-over-year power generation in thousand megawatt hours for three different sources.

Through September 2025 YTD (highlighted area right side of chart), natural gas-fired generation has seen an average monthly decline of 6.02 GW hours of YOY reduction, while utility-scale solar has averaged 6.87 GW hours of YOY increase per month. Surprising to some, coal has averaged an increase of 7.15 GW hours per month of power generation. For all three, the trend has held for every month in 2025.

So, can we expect this trend to continue? Despite the impacts of the One Big Beautiful Bill Act (OBBBA) and the early sunsetting of tax credits for solar, year-over-year growth in solar generation is expected to continue as developers add capacity before incentives expire.

For coal, a combination of things will need to fall into place: near term, peak day and overall monthly power demand growth, particularly in the winter, will likely keep the coal trend going for a few more months until winter’s end. Beyond Q1 2026, natural gas prices will be the key variable. The NYMEX Last-Day Settle averaged $3.427/MMBtu for 2025 — $1.16 above 2024 — giving coal an economic edge this year. Whether that edge persists will determine if the coal trend continues. Absent overall demand growth of power weak gas prices starting Q2, it will be difficult for coal to maintain the YOY growth long term.

One other thing that could prevent coal from making this a long-term trend is the physical stockpiles of coal available for use. As of the EIA’s September Stocks of Coal report, stockpiles for the power sector were 17.2 million short tons behind last year’s levels. If stockpiles aren’t available for use, coal can’t be burned.

For natural gas, a couple of things will likely need to fall into place to continue the year-over-year decline much longer. While the official EIA numbers for Q4 haven’t yet materialized, in the eastern half of the U.S. (PJM and MISO), where natural gas is utilized more, cooler weather arrived in the first half of December, requiring more natural gas to meet demand. Meanwhile, natural gas prices have reacted to a much warmer weather forecast for the second half of the month. If the warmer forecast holds and spot prices track the NYMEX January 2026 pricing — down more than $1.25/MMBtu since 12/5 — the coal price advantage would narrow. That could trigger coal-to-gas switching, lift gas burns in the second half of December, and give natural gas a chance to end 2025 with its first year-over-year gain in power generation.