Perspective is subjective: Overpriced Cal26 or long-term opportunity for natural gas?

By Jeff Bolyard

When it comes to an individual’s perspective on any important decision, their unique history, experiences, feelings, and interpretations significantly impact their viewpoint on the inputs and potential outcome of the decision that needs to be made. In other words, their perspective is subjective and is not necessarily universally true for others.

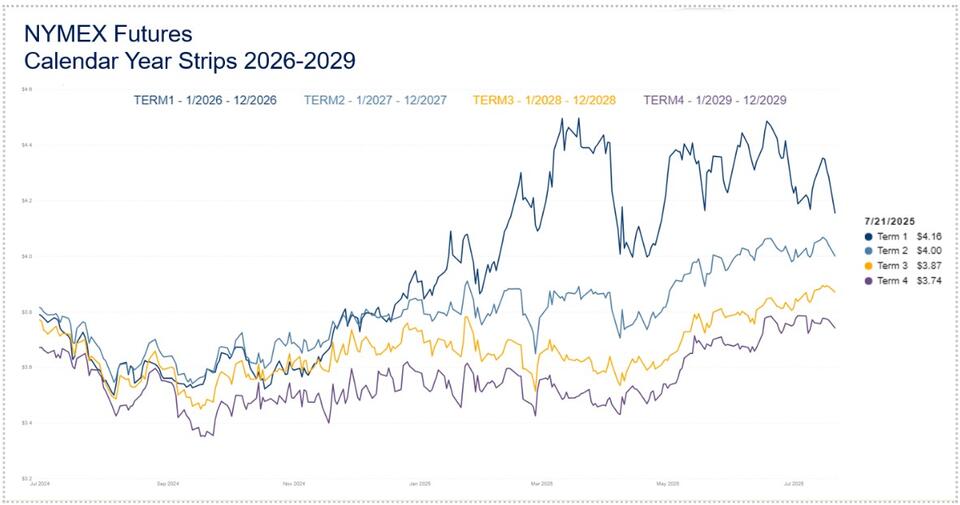

Typically, in the natural gas futures market, the price of natural gas is higher as time passes and is in contango to near-term prices. However, the current NYMEX natural gas futures market is in a somewhat unusual position that indicates declining pricing each year with the NYMEX futures calendar strips from 2026 through 2029, decreasing in price each year.

The chart below shows the history of each of those four calendar strips with the current pricing (as of 7/25) on the far right.

So, the question industrial gas buyers are asking themselves is whether the current market is overpriced for Cal26 or whether the lower cost in 2027, 2028 and 2029 is an opportunity to fix pricing. In short, the answer to this question depends upon the experiences and knowledge of each individual asking themselves the question, which is subjective. Any future buying decision for a company that goes out multiple years for a volatile priced commodity for natural gas that commits to a significant amount of expense for that company should have a procurement/risk management strategy that gets buy-in from multiple perspectives within your organization.

Trio recommends that relevant individuals and departments within an organization engage in the development of a strategy, which can vary by company based on their experience and history of previous decisions.

My perspective on whether the current gas market is overpriced in the near term (2026), or a solid long-term opportunity for 2027-2029, is also based on history and experience. As of 7/25/25, Cal 2026 was trading at $4.03/MMBtu, Cal ’27 @ $3.93, Cal ’28 @ $3.82 & Cal ’29 @ $3.70/MMBtu. Fundamentally, the short-term market (through the end of 2025) is sufficiently supplied through the balance of the year. But starting in 2026, the supply -demand balance is expected to swing to the short side, with over 10 Bcf/day of incremental LNG demand under construction in the U.S.

The drilling rig counts for natural gas have started to rise (up 14 YOY), primarily in the Haynesville, while crude oil rigs are down YOY, with limited incremental associated gas anticipated at this level of drilling. Overall, the fundamentals line up bullishly with what is likely to play out in 2026 with what we see today in the fundamental picture. The 2027-2029 period, while not attractive compared to 2024 NYMEX settlements and has significant upside risk, has not been impacted by the near-term concern currently focused on 2026.

The current backwardated view should not be taken as a foregone conclusion that a long-term surplus of supply is already in the cards. Instead, it should be seen as an opportunity for a layer of protection in a volatile market for industrial buyers that are naturally short, that will have to purchase natural gas at some point and can ill afford price spikes that are fundamentally more likely to occur than a significant drop based on what is seen in the markets today.