Day of reckoning: Convergence of NYMEX final settlement and Henry Hub Cash

By Jeff Bolyard

Just three business days before the end of the month, something predictable happens in the natural gas markets: the nearest NYMEX futures contract being bought and sold, also called the “prompt month” contract, ceases to be a future month and goes to final settlement. Any buyer or seller with a NYMEX Last Day Settlement (LDS) natural gas contract structure will receive the final end-of-day settlement price.

This price structure is a liquidly traded, market-based monthly price benchmark tied to the Henry Hub, but the Henry Hub location is also home to a spot price benchmark of the same name.

The Henry Hub Spot (HHS) market, also known as the cash market or physical short-term market, is similar in name and location to the NYMEX Henry Hub LDS futures contract. However, it is only bought and sold for immediate delivery. The NYMEX Henry Hub (NHH) is priced by the month, while the HHS is priced by the day.

These two natural gas trading markets are driven by different market conditions and types of buyers and sellers. The markets can vary significantly in price as the HHS reflects short-term, daily market conditions, while the NYMEX prompt month settlement is determined monthly. While separated by several weeks at the very start of every month, the HHS daily pricing and the immovable NYMEX prompt month get closer to each other as each day passes until, on the third business day prior to the end of each month, they get as close to each other in time as the natural gas market rules allow.

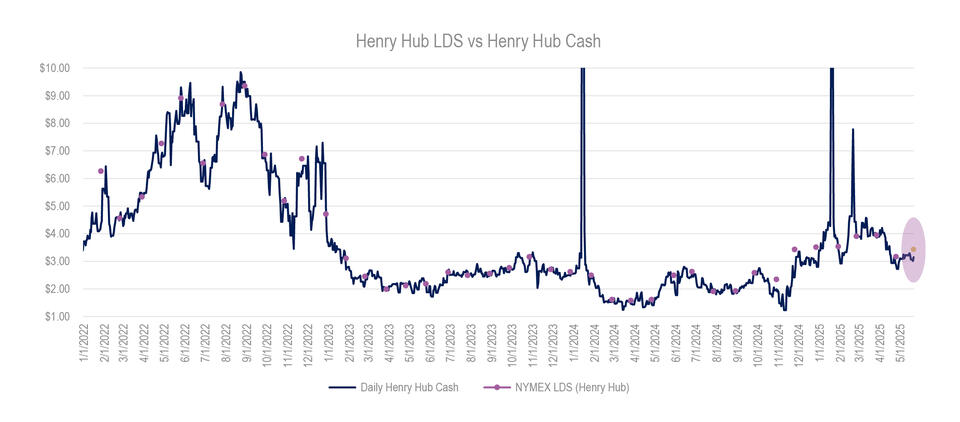

It is at this point that the two markets are forced to converge in price, with very few exceptions. The chart below shows how volitively the Henry Hub Spot market (dark blue solid line) can move in any given month. Plotted on the same chart (purple dots) is the LDS over the same period. As you can see, these two market structures trend towards each other within a few days of the LDS expiration, often within a few pennies of each other.

On the far right, highlighted by the oval, the NYMEX Prompt Month of June (red dot) is shown as trading at $3.49/MMBtu, while the HHS price (blue line within the oval) is at a $0.28 discount to that price at $3.15/MMBtu. The day of reckoning is coming when these two prices, absent an anomaly, will need to get much closer together. Significant price differences between HHS and NYMEX LDS pricing often occur in winter, with the onset of extreme weather forecasts. These forecasts can impact spot pricing near the end of a month or influence LDS pricing if the cold weather is expected to continue in the first week or so of the next month. In some cases, non-fundamental, high-volume speculative trading can cause significant price movements and impact LDS pricing.

With such a sizable gap between HHS and NYMEX prompt month pricing and just a week before this month’s LDS, the next several sessions could bring some fireworks to daily price action. The question is whether HHS will increase or whether LDS will decline between now and the third business day prior to the end of the month. Don’t worry - if you miss it, history indicates that it will likely happen again next month.